Fertilizers Market Size to Surpass USD 380.16 Billion by 2035

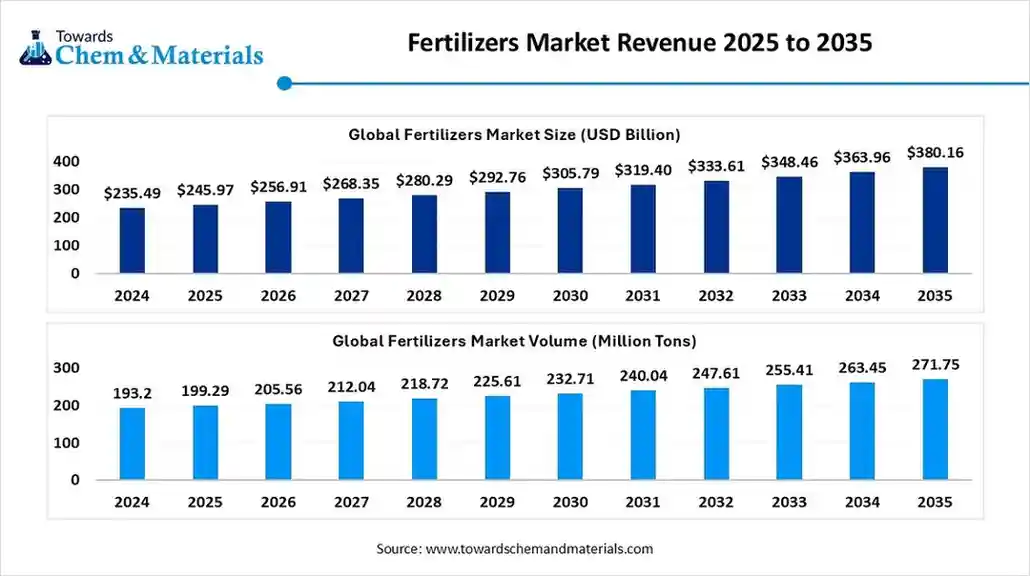

According to Towards Chemical and Materials Consulting, the global fertilizers market size is calculated at USD 245.97 billion in 2025 and is expected to surpass around USD 380.16 billion by 2035, growing at a CAGR of 4.45% from 2025 to 2035.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) -- The global fertilizers market size was valued at USD 235.49 billion in 2024 and is anticipated to reach around USD 380.16 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.45 % over the forecast period from 2025 to 2035. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5578

According to Towards Chemical and Materials Consulting, the global fertilizers market size reached a volume of 199.29 million tons in 2025 the market is projected to reach a volume of 271.75 million tons by 2035, exhibiting a growth rate (CAGR) of 3.15% during 2025-2035.

What is Fertilizer?

The global fertilizer market is extensively shaped by rising food demand, shrinking arable land, and intensifying efforts to boost crop productivity. Modern agriculture practices such as precision farming, improved nutrient delivery, and sustainable formulations are increasingly influencing how growers select and use fertilizers. Geographically, the Asia Pacific region holds a dominant position in terms of volume and value, thanks to large agricultural bases, government support, and the rapid adoption of advanced agro-technologies. Meanwhile, market expansion is further propelled by segments such as bio-based fertilizers and specialty formulations, which respond to growing environmental concerns and evolving farming practices.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Fertilizers Market Report Highlights

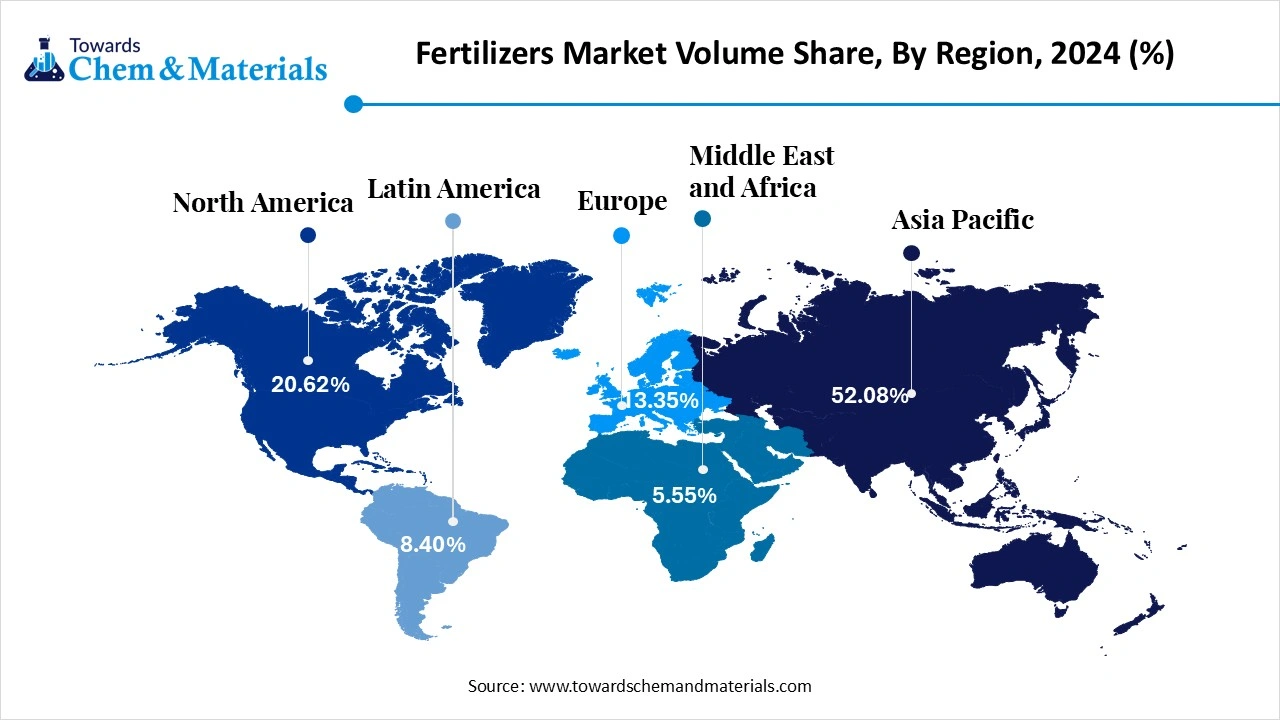

- The Asia Pacific fertilizers dominated the global market and accounted for the largest Volume Share of 52.08% in 2024.

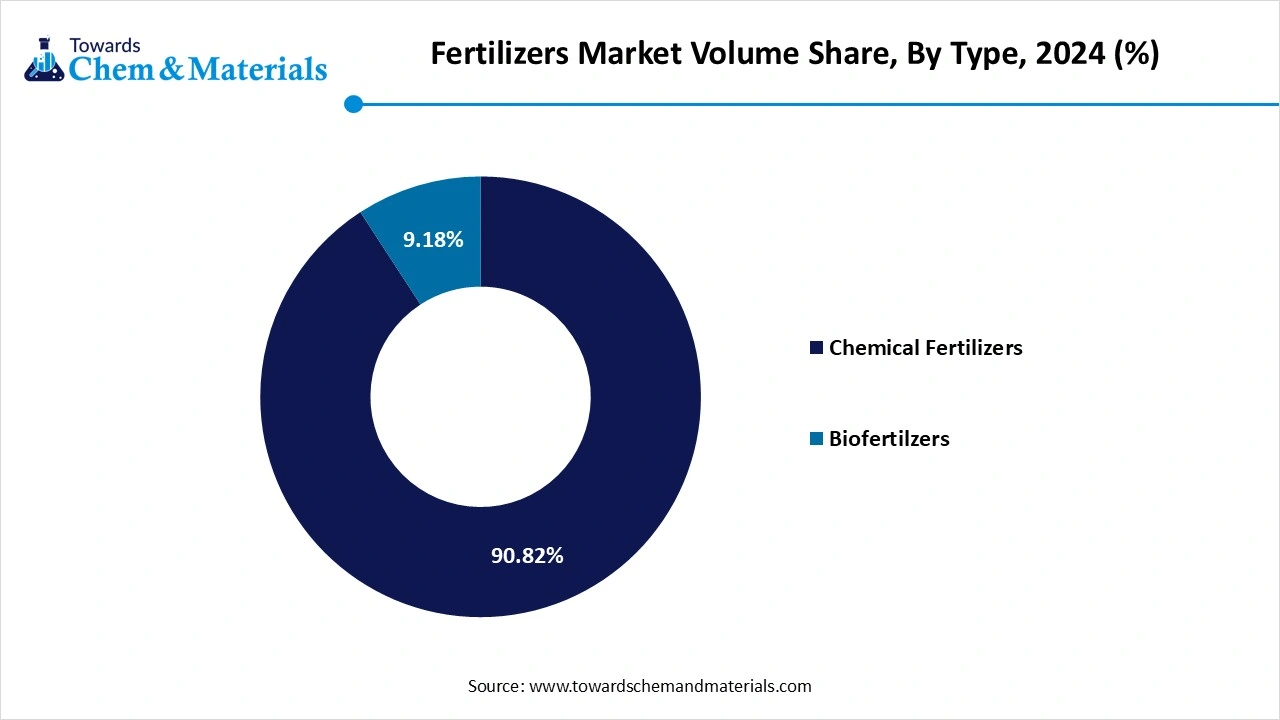

- By type, the chemical fertilizers segment led the market and accounted for the largest Volume Share of 90.82% in 2024

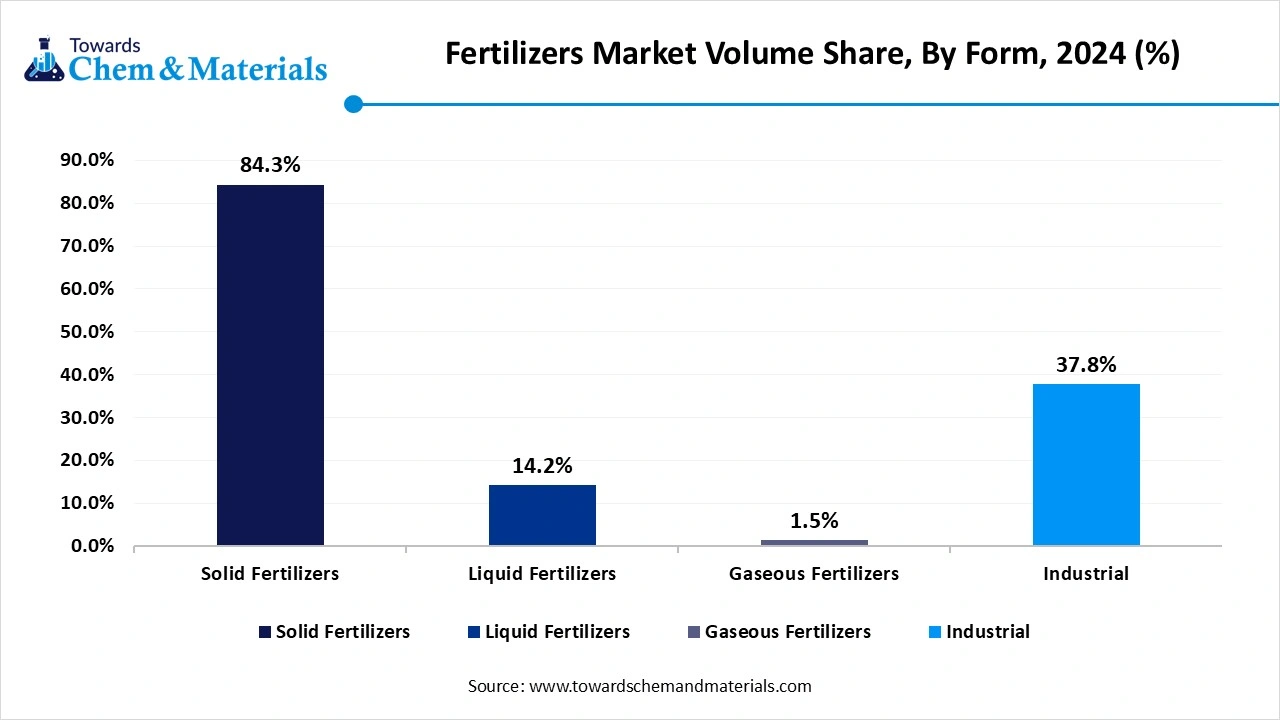

- By form, the solid fertilizers segment led the market with the largest Volume Share of 84.3% in 2024.

- By crop type, the Cereals & Grains segment led the market with the largest Volume Share of 42.76% in 2024.

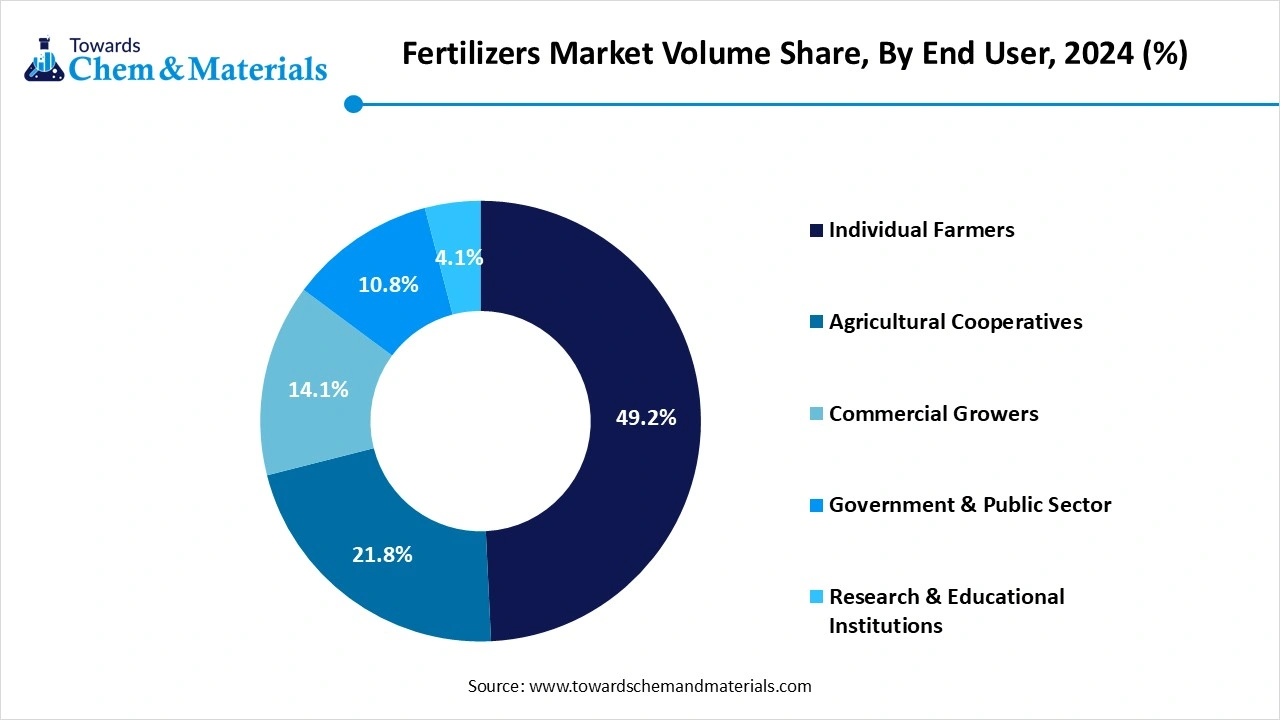

- By end-user, the individual farmers segment led the market and accounted for the largest Volume Share of 49.2% in 2024

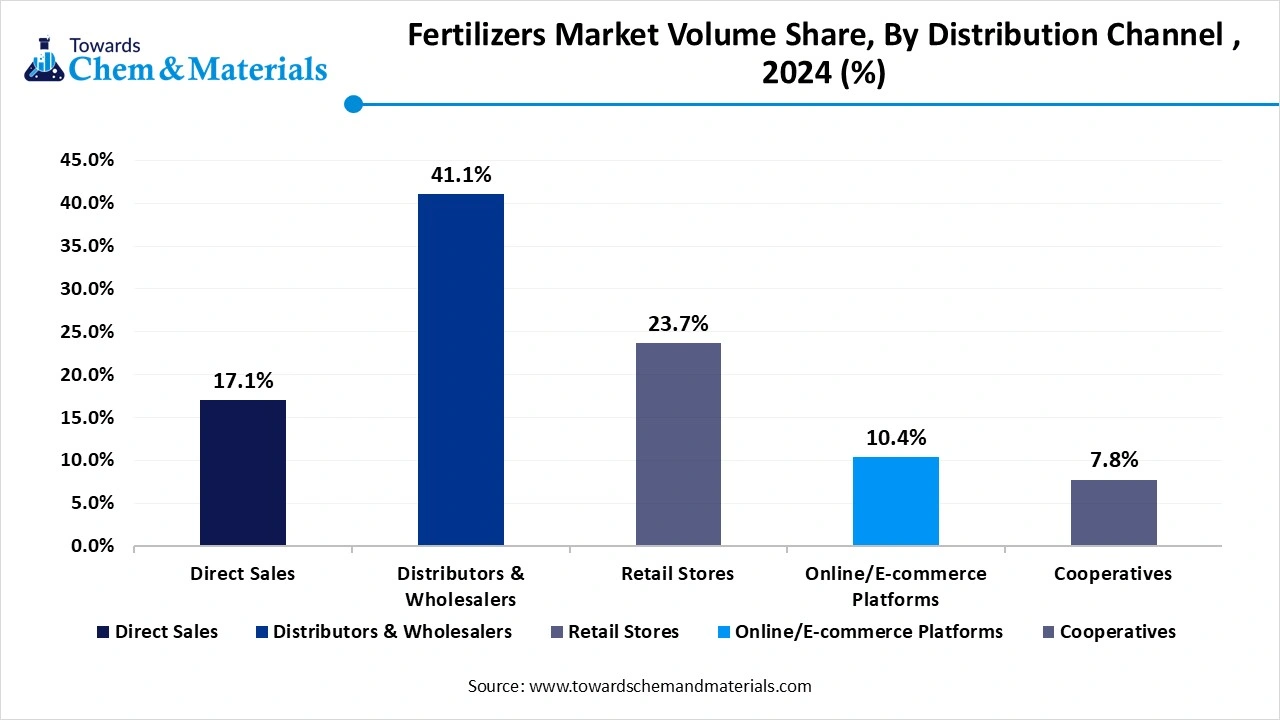

- By distribution channel, the distributors & wholesalers segment led the market with the largest Volume Share of 41.1% in 2024.

What are the Major Government Initiatives for Fertilizers?

- Fertilizer Subsidy Scheme (including Direct Benefit Transfer - DBT): The government provides significant financial support to manufacturers and importers to ensure essential fertilizers like urea and P&K products are available to farmers at affordable, government-controlled or indicative prices.

- Nutrient Based Subsidy (NBS) Scheme: For non-urea fertilizers, this scheme fixes the subsidy amount based on their nutrient content (N, P, K, S) to encourage balanced fertilization and allow companies to set market-reflective retail prices.

- One Nation One Fertilizer (ONOF) / Pradhan Mantri Bhartiya Jan Urvarak Pariyojana (PMBJP): This initiative mandates that all subsidized fertilizers be sold under a single brand name, "Bharat," to standardize quality, reduce confusion among farmers, and minimize unnecessary transportation costs.

- Soil Health Card (SHC) Scheme: This program provides farmers with a detailed report on their soil's nutrient status and customized recommendations on the appropriate type and dosage of fertilizers to promote optimal use and long-term soil health.

-

PM-PRANAM (Programme for Restoration, Awareness, Nourishment, and Amelioration of Mother Earth): A new scheme that incentivizes states to reduce the use of chemical fertilizers and encourages the adoption of organic and alternative nutrients through grants derived from subsidy savings.

What are the largest producers of fertilizers in the world?

The countries with the highest volumes of production in 2024 were China, the United States and Russia, together accounting for 37% of global production. India, Canada, Saudi Arabia, Indonesia, Belarus, Germany and Iran lagged somewhat behind, together comprising a further 27%.

What are the leading suppliers of fertilizers in the world?

In value terms, Russia remains the largest fertilizer supplier worldwide, comprising 20% of global exports. The second position in the ranking was taken by China, with a 9.4% share of global exports. It was followed by Canada, with a 7.7% share.

What are the leading importers of fertilizers in the world?

In value terms, Brazil, India and the United States appeared to be the countries with the highest levels of imports in 2024, with a combined 33% share of global imports. China, Australia, Thailand, Canada, France, Turkey and Indonesia lagged somewhat behind, together accounting for a further 19%.

What is the average export price for fertilizers in the world?

In 2024, the average fertilizer export price amounted to $424 per ton, which is down by -3.4% against the previous year. Over the period under review, the export price showed a relatively flat trend pattern. The most prominent rate of growth was recorded in 2022 when the average export price increased by 67%. As a result, the export price reached the peak level of $639 per ton. From 2023 to 2024, the average export prices remained at a somewhat lower figure.

What is the average import price for fertilizers in the world?

In 2024, the average fertilizer import price amounted to $416 per ton, shrinking by -4.2% against the previous year. Over the period under review, the import price saw a relatively flat trend pattern. The growth pace was the most rapid in 2022 an increase of 71% against the previous year. As a result, import price attained the peak level of $675 per ton. From 2023 to 2024, the average import prices remained at a lower figure.

This report provides an in-depth analysis of the global fertilizer market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2035.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5578

Fertilizers Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 256.91 billion |

| Revenue forecast in 2035 | USD 380.16 billion |

| Growth rate | CAGR of 4.45% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2025 |

| Forecast period | 2025 - 2035 |

| Quantitative Units | Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2035 |

| Segments covered | By Form, By Type, By Crop Type, By Application, By End User, By Distribution, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

| Key companies profiled | ICL (Israel), Yara (Norway), K+S Aktiengesellschaft (Germany), Nutrien (Canada), Mosaic (US), CF Industries Holdings, Inc. (US), Grupa Azoty (Poland)SQM S.A. (Chile), OCP (Morocco), Syngenta Group (Switzerland), Saudi Basic Industries Corporation (Saudi Arabia), Koch IP Holdings, LLC (US), Haifa Negev technologies LTD (Israel), EuroChem Group (Switzerland), Lallemand Inc (Canada), IPL Biologicals (India), BIONEMA (UK), Multiplex Group of Companies (India)Vise Organic (India), Kula Bio,Inc. (US), Switch Bioworks (US), AgroLiquid (US), Rovensa Next (Spain), AgriLife (India), Gênica (Brazil) |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Types of Fertilizers

Fertilizers are mainly classified into two groups: synthetic (chemical) and organic (natural). Each type has advantages and disadvantages, and their use depends on crop needs, soil conditions, and farming practices.

Synthetic (Chemical) Fertilizers

These are manufactured chemically and are often concentrated sources of nutrients. Synthetic fertilizers provide rapid nutrient release for quick plant uptake, supporting fast crop growth.

- Nitrogenous Fertilizers: Urea, ammonium nitrate, ammonium sulfate.

- Phosphatic Fertilizers: Single superphosphate, triple superphosphate.

- Potassic Fertilizers: Potassium chloride, potassium sulfate.

- Complex/Mixed Fertilizers: Contain two or three main nutrients (e.g., NPK blends).

Example: Urea is a widely used nitrogen fertilizer with about 46% nitrogen content.

Organic (Natural) Fertilizers

These fertilizers are produced from plant or animal residues. They enrich the soil with organic matter and nutrients, improve soil structure, and promote microbial activity.

- Farmyard Manure (FYM): Mixture of livestock droppings, urine, and bedding materials.

- Compost: Decomposed plant material, kitchen waste, garden waste.

- Green Manure: Plants like legumes grown and plowed into the soil to add nutrients (especially nitrogen).

- Vermicompost: Organic matter decomposed by earthworms, rich in nutrients and beneficial microbes.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5578

What Are the Major Trends in The Fertilizer Market?

- The growing awareness of environmental impact is shifting demand toward bio-based and eco-friendly fertilizer formulations.

- Technological advancements such as precision agriculture tools and soil sensor-driven nutrient application are influencing manufacturer and farmer practices.

- The rise of liquid and specialty form fertilizers is gaining momentum due to their flexibility in application and compatibility with modern farming techniques.

- Distribution channels are evolving, with online/e-commerce platforms increasingly becoming important for fertilizer purchases and farmers’ accessibility.

- Governments and regulatory bodies are intensifying support for sustainable agriculture, encouraging shifts away from conventional fertilizers toward more efficient and less polluting alternatives.

How Does AI Influence the Growth of The Fertilizer Industry In 2025?

The integration of artificial intelligence (AI) into agriculture is reshaping the fertilizer industry in 2025 by enabling far more precise nutrient application. AI-driven systems use real-time sensor data, satellite imagery, and predictive analytics to tailor fertilizer usage to exact plant and soil conditions. This helps reduce waste, improve yields, and align with sustainability goals.

For fertilizer producers and distributors, this shift means evolving from commodity supply toward offering value-added digital services and agronomic guidance. AI-powered platforms help these companies deliver smarter solutions, strengthen customer relationships, and tap into new revenue streams informed by data.

Fertilizers Market Segmentation Insights

Type Insights:

Why Chemical Fertilizers Remain Dominant in the Fertilizer Market?

The chemical fertilizers segment dominated the market in 2024. This dominance reflects the widespread use of inorganic nutrients that are rapidly available to crops, fitting the needs of intensive agriculture and staple crop production. The familiarity of farmers with conventional formulations, strong distribution systems, and government policies supporting nutrient supply has all reinforced the persistence of chemical fertilizers as the primary choice in many regions.

The bio-fertilizers segment is projected to expand rapidly in the market in the coming years. This growth is driven by rising interest in sustainable agriculture, reduced environmental impact, and the shift toward low-input farming systems. Companies developing microbial, organic, or nutrient-enhancing biological products are increasingly able to tap into farms seeking alternatives to conventional chemicals.

Form Insights:

Why Do Solid Fertilizers Dominate the Fertilizer Market?

The solid fertilizers segment accounted for a leading position in the market share of 84.3% in 2024. The appeal lies in ease of storage and spreading, compatibility with existing equipment, longer shelf life, and broad suitability across many crops and soils. These advantages maintain the dominance of solid forms, especially in broad-acre farming and regions where infrastructure supports them.

The liquid fertilizers segment is anticipated to grow with the highest CAGR during the studied years. This trend is supported by increasing adoption of precision agriculture, fumigation, and foliar application technologies that benefit from liquid's ability to deliver nutrients more uniformly and quickly. The move toward high-value crops, integrated irrigation systems, and nutrient-efficient farming further encourages the uptake of liquid forms.

Crop Type Insights:

Why Cereals & Grains Dominate the Fertilizer Market?

The cereals and grains segment dominated the market share in 2024. This reflects the global emphasis on staple food cultivation, including wheat, rice, and maize, which demand regular and high-volume fertilisation to maintain productivity and food security goals. The familiarity of farmers with nutrient requirements for broad-acre cereal crops, along with established supply chains for fertilisers in those systems, reinforces this segment’s dominance.

The fruits and vegetables segment are expected to expand at the fastest rate during the forecast period. This is driven by increasing consumer demand for fresh, healthy, and premium produce, which in turn encourages adoption of more precise fertiliser regimes and higher value nutrient solutions. As horticulture and protected cultivation become more common, fertiliser products tailored to fruits and vegetables gain traction.

End User Insights:

Why Individual Farmers Hold the Largest Share in the Fertilizer Market?

The individual farmers segment holds the largest share of the market share of 49% in 2024. This stems from the fact that small to medium-scale growers collectively represent a large proportion of agricultural land globally and hence consume the majority of fertiliser volume. Their established purchasing patterns, dependency on traditional fertiliser types, and outreach make them a major shareholder in fertiliser markets.

The commercial grower’s segment is projected to develop with the highest growth rate over the forecast period. This is because large-scale farms and agribusinesses increasingly adopt advanced fertiliser technologies, precision nutrient management, and value-added fertiliser products. Their higher investment capacity and focus on yield optimisation generate demand for more sophisticated fertiliser solutions.

Distribution Channel Insights:

Why do distributors and Wholesalers dominate the fertilizer Market?

The distributors & wholesalers segment held the largest share of 41.1% in 2024. Their expansive networks, bulk handling capacity, and established relationships with manufacturers and framers enable them to serve wide geographic areas effectively. They remain the backbone of traditional fertiliser supply chains, especially in regions where remote farms and logistics challenges prevail.

The online/e-commerce platforms segment is expected to gain the highest growth momentum during the forecast period. The rise of internet penetration in rural areas, the convenience of digital ordering and home delivery, and the availability of expert advice via platforms are driving farmers to adopt online fertiliser purchasing. These trends reshape how fertilisers reach end users, offering new access models, especially in emerging markets.

Regional Insights

Why Is the Asia Pacific Region Dominant in The Market?

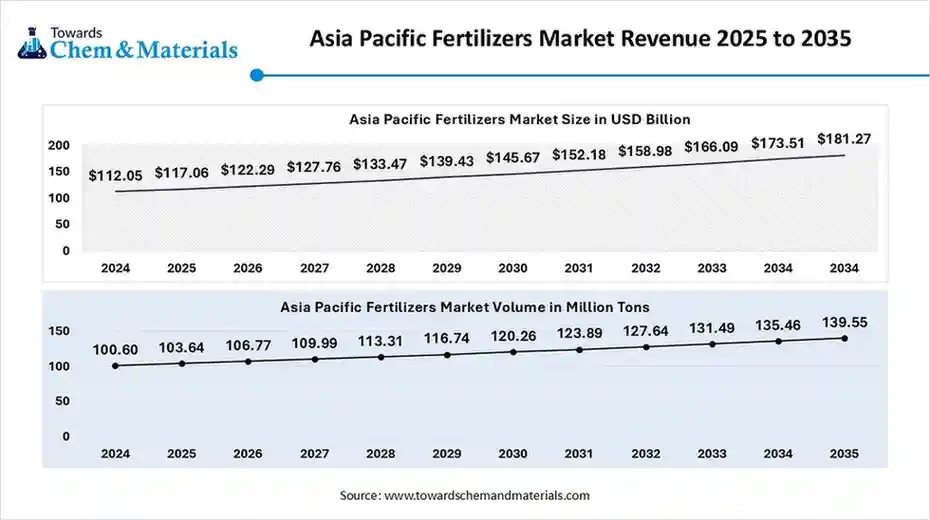

The Asia Pacific fertilizers market it was estimated at USD 117.06 billion in 2025 and is projected to reach USD 181.27 billion by 2035, growing at a CAGR of 4.47% from 2025 to 2035.

The Asia Pacific fertilizers Market is expected to reach a volume of approximately 103.64 million tons in 2025, with a forecasted increase to 139.55 million tons by 2035, growing at a CAGR of 3.02% from 2025 to 2035.

The Asia Pacific region dominated the market in 2024, due to its extensive agricultural base, large population, and high dependence on cop cultivation for food security and income. Countries such as China, India, and Indonesia heavily invest in fertilizer usage to enhance productivity and maintain soil fertility. Government initiatives supporting sustainable agriculture, combined with advancements in precision farming and controlled-release fertilizers, have strengthened the region’s market presence.

Additionally, the rising demand for food grains and horticulture crops further accelerates fertilizer consumption, making the Asia Pacific a central hub for fertilizer production and trade.

India Fertilizer Market Outlook:

India plays a pivotal role in the regional fertilizer landscape due to its vast agricultural sector and government programs promoting nutrient management and self-reliance in fertilizer production. The country’s growing awareness of balanced fertilization, alongside initiatives such as soil health cards and direct benefit transfers for farmers, supports steady fertilizer use across major crop types. Moreover, India’s increasing adoption of bio-fertilizers and sustainable farming techniques is driving transformation in the domestic market, positioning it as a key growth engine within the Asia Pacific’s fertilizer industry.

What Is Driving Growth in The North America Fertilizer Industry?

North America is projected to experience the highest growth rate in the market between 2025 and 2035. Farmers are embracing tools that optimise nutrient delivery and minimise waste, which supports higher uptake of specialty and bio-based fertilizers. Regulatory pressures to reduce environmental impact also steer the market toward advanced fertiliser solutions tailored for sustainable agriculture.

U.S. Fertilizer Market Analysis:

The U.S. stands out in the North American market thanks to its vast agricultural land base, strong infrastructure, and advanced research ecosystem in fertilizer technologies. The country’s large acreage of high-nutrient-demand crops and established distribution networks provide fertile ground for both conventional and next-generation fertilizers. This string foundation enables the U.S. to play a leading role in the region’s nutrient input industry.

Top Companies in the Fertilizer Market

- Nutrien Ltd: As the world's largest producer of potash and a major producer of nitrogen and phosphate, Nutrien offers a comprehensive range of crop inputs, including solid, liquid, and specialty fertilizers, along with seed and crop protection products, through its extensive global retail network.

- Yara: Yara International is a global crop nutrition company that produces, distributes, and sells a complete portfolio of nitrogen, phosphate, and potash-based mineral and specialty fertilizers, including nitrate, NPK, and water-soluble formulations, alongside digital farming tools and environmental solutions.

- ICL: ICL specializes in the production of a wide array of specialty mineral-based fertilizers, including advanced controlled-release, water-soluble, and foliar products, that aim to enhance nutrient efficiency and promote sustainable agriculture.

- The Mosaic Company: Mosaic is the world's largest combined producer of concentrated phosphate and potash, mining these essential minerals to create a broad range of bulk and value-added fertilizers, as well as animal feed ingredients.

- CF Industries and Holdings, Inc.: CF Industries is a leading global manufacturer of hydrogen and nitrogen products, focusing primarily on ammonia, urea, and UAN (urea ammonium nitrate) fertilizers for agricultural and industrial customers.

- Nufarm: Nufarm's primary business is crop protection (herbicides, insecticides, and fungicides) and seeds technology, though some regional entities like Nufarm Agri Solutions LLP also supply fertilizers and specialty nutrients.

- SQM SA (Sociedad Quimica y Minera de Chile SA): SQM, which is the same entity as Sociedad Quimica y Minera de Chile SA, produces a variety of specialty plant nutrients, including potassium nitrate, potassium sulfate, and other specialty blends, by leveraging its unique salt brine and caliche ore deposits in Chile.

- OCP Group: OCP Group is the world's largest producer of phosphate-based products, engaged in the entire value chain from mining phosphate rock to manufacturing customized conventional and fortified fertilizers (DAP, MAP, TSP, NPK) tailored to specific crop and soil needs.

- K+S Aktiengesellschaft: K+S is Europe's largest supplier of potash, producing and distributing a wide range of potash and magnesium-based mineral fertilizers and specialties for soil, fertigation, and foliar application.

- Eurochem Group: EuroChem is a leading international producer of nitrogen, phosphate, and potash fertilizers, offering a full range of high-quality basic and premium products, including inhibited and water-soluble fertilizers, through its mine-to-farm integrated supply chain.

More Insights in Towards Chemical and Materials:

- U.S. Fertilizers Market : The U.S. fertilizers market size is calculated at USD 30.56 billion in 2025 and is projected to reach USD 32.08 billion in 2026, further anticipated to reach around USD 47.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.97% over the forecast period from 2025 to 2034.

- Asia Pacific Fertilizers Market : The Asia Pacific fertilizers market size was valued at USD 168.71 billion in 2024 and is anticipated to reach around USD 313.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.39% over the forecast period from 2025 to 2034.

- U.S. Nitrogenous Fertilizers Market : The U.S. nitrogenous fertilizer market size is calculated at USD 20.42 billion in 2025 and is predicted to increase from USD 21 billion in 2026 to approximately USD 26.29 billion by 2034, expanding at a CAGR of 2.85% from 2025 to 2034.

- Asia Pacific Nitrogenous Fertilizer Market : The Asia Pacific nitrogenous fertilizer market size was valued at USD 89.92 billion in 2024, grew to USD 95.11 billion in 2025, and is expected to hit around USD 157.57 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.77% over the forecast period from 2025 to 2034.

- Nitrogenous Fertilizer Market : The global nitrogenous fertilizer market size was reached at USD 128.26 billion in 2024 and is expected to be worth around USD 224.55 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.76% over the forecast period from 2025 to 2034. Increasing health awareness and innovation in the textile industry have driven market growth.

- Fertilizer Catalysts Market : The fertilizer catalysts market size is calculated at USD 3.45 billion in 2024, grew to USD 3.56 billion in 2025, and is projected to reach around USD 4.75 billion by 2034. The market is expanding at a CAGR of 3.25% between 2025 and 2034.

- Sulfur Fertilizer Market : The global sulfur fertilizer market size was approximately USD 4.95 billion in 2024 and is projected to reach around USD 8.02 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 4.95% between 2025 and 2034

- Specialty Fertilizers Market : The global specialty fertilizers market volume was reached at 30.23 million tons in 2024 and is expected to be worth around 49.33 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- Phosphate Fertilizers Market : The global phosphate fertilizers market size is calculated at USD 70.11 billion in 2024, grew to USD 74.28 billion in 2025, and is projected to reach around USD 124.97 billion by 2034. The market is expanding at a CAGR of 5.95% between 2025 and 2034.

- Organic Fertilizers Market : The global organic fertilizers market size is projected to be worth around USD 21.93 billion by 2034 from USD 12.34 billion in 2024, at a CAGR of 5.92% from 2025 to 2034.

- Liquid Fertilizers Market : The global liquid fertilizers market size is calculated at USD 2.96 billion in 2025 and is predicted to increase from USD 3.09 billion in 2026 to approximately USD 4.36 billion by 2034.

- Controlled Release Fertilizers Market : The global controlled release fertilizers market size was reached at USD 2.50 billion in 2024 and is expected to be worth around USD 4.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.02% over the forecast period 2025 to 2034.

- Industrial Water Treatment Market : The global industrial water treatment market size is calculated at USD 49.26 billion in 2025 and is predicted to increase from USD 51.80 billion in 2026 and is projected to reach around USD 81.40 billion by 2035, The market is expanding at a CAGR of 5.15% between 2025 and 2035.

- Textile Market : The textile market size was estimated at USD 1.33 trillion in 2024 and grew to USD 1.39 trillion in 2025, and is projected to reach around USD 2.01 trillion by 2034. The market is expanding at a CAGR of 4.24% between 2025 and 2034.

-

U.S. Water and Wastewater Treatment Market : The U.S. water and wastewater treatment market size was accounted for USD 121.85 billion in 2024 and is predicted to increase from USD 130.31 billion in 2025 to approximately USD 238.36 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034.

Fertilizers Market Top Key Companies:

- ICL (Israel)

- Yara (Norway)

- K+S Aktiengesellschaft (Germany)

- Nutrien (Canada)

- Mosaic (US)

- CF Industries Holdings, Inc. (US)

- Grupa Azoty (Poland)

- SQM S.A. (Chile)

- OCP (Morocco)

- Syngenta Group (Switzerland)

- Saudi Basic Industries Corporation (Saudi Arabia)

- Koch IP Holdings, LLC (US)

- Haifa Negev technologies LTD (Israel)

- EuroChem Group (Switzerland)

- Lallemand Inc (Canada)

- IPL Biologicals (India)

- BIONEMA (UK)

- Multiplex Group of Companies (India)

- Vise Organic (India)

- Kula Bio,Inc. (US)

- Switch Bioworks (US)

- AgroLiquid (US)

- Rovensa Next (Spain)

- AgriLife (India)

- Gênica (Brazil)

Market Recent Developments

- In July 2025, A major Indian fertiliser manufacturer, Deepak Fertiliser and Petrochemicals Corporation, reported a strong quarterly profit increase, which the company attributed to robust demand for crop nutrition products and higher volumes of complex fertilisers. This performance highlights how demand for advanced nutrient solutions is accelerating in one of the world’s large agricultural markets.

- In July 2025, Oil India Ltd. formed a joint venture with the government of the Indian state of Assam to set up a new fertilizer production plant in the region, signalling a push for enhanced domestic manufacturing and regional agriculture support.

Fertilizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Fertilizers Market

By Form

- Solid Fertilizers

- Granules

- Powder

- Liquid Fertilizers

- Solution

- Suspension

- Gaseous Fertilizers

- Ammonia (used in large-scale farming)

By Type

- Chemical Fertilizers

- Biofertilizers

By Crop-Type

- Cereals & Grains

- Frutis & Vegetables

- Oilseeds & Pulses

- Others

By Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

- Others Mode of Transport

By End User

- Individual Farmers

- Agricultural Cooperatives

- Commercial Growers

- Government & Public Sector

- Research & Educational Institutions

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Retail Stores

- Online/E-commerce Platforms

- Cooperatives

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5578

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.